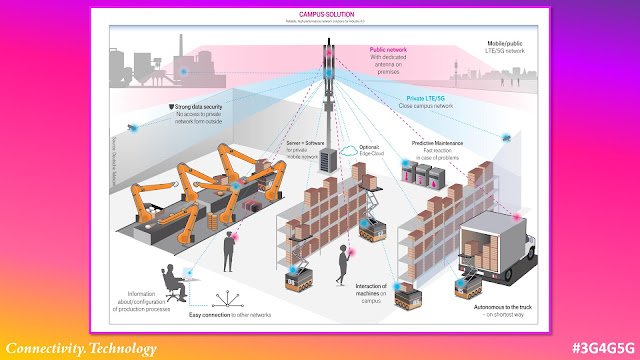

Deutsche Telekom has been actively promoting Campus Networks for a while and their website defines Campus networks as exclusive mobile networks for a defined local campus, a university or individual buildings, such as an office building. They are tailored to the individual needs of users and meet future requirements in the area of Industry 4.0.

This introductory video from them is a good place to understand the basics as well.

If you are not very familiar with private networks (or non-public networks as 3GPP calls them), then my old tutorial is a good place to start. I also cover the basics of Campus Networks in that.

5G Private Networks and Responsibilities from The 3G4G blog post '5G Private and Non-Public Network (NPN)' - https://t.co/hicWpkmpJr via @3g4gUK#Free5GTraining #3G4G5G #PrivateLTE #PrivateNetworks #NPN #Private5G #Enterprise5G #Industrie40 #Industrial5G pic.twitter.com/3UBq5Iq0c7

— Free 5G Training (@5Gtraining) February 7, 2021

At the Private Networks in 5G World Conference back in June, Antje Williams, Senior VP at Deutsche Telekom made some very relevant points about Campus networks. Enterprise IoT Insights have a good summary here. The following is a brief extract from that:

Antje Williams was on stage, preaching patience – which is a revelation in itself; for a telco to keep its head, while all around rival suppliers are losing theirs (and blaming it on telecoms). She made a bunch of hype-righting points: notably, that private 5G is, effectively, an all-China market for the moment, with industry incentivised by the government to install 5G (from Chinese suppliers).

By contrast, just 15 percent of (about 110) ‘vertical’ spectrum licencees in Germany have so far committed to commercial (or planned-commercial) operations; the rest are doing tests – which ABI Research made clear in a recent Enterprise IoT Insights report is time-limited, with future governmental and institutional funds shortly pegged for 6G. “I see the same in the US,” she said; a statement that will likely get the backs-up of the twitchy CBRS crowd.

So don’t be so easily carried away; scorching CAGR forecasts from analysts start at almost-freezing, she reminded the room. “That is the situation we are in; we have to make sure we go from research to business. At the moment, the number of campus networks is too low for operators to make investments in.” The end of the sentence is scrambled in the notes, but the message is that private 5G is not even a given, without hard work and urgent progress.

There are no (Release 16) industrial-grade 5G devices, she noted. “We started with NSA, and we thought it was a good idea. Customers wanted SA. ‘Okay, but there are no devices – so bear that in mind.’… And we have had a couple of escalations now because they can’t use the network [because there are no devices].” How do you justify a network you cannot attach to? How do you build a market based on a lie? Or so Williams implied, in different words.

It is not because the invention is bad, but because a lot of things have to happen for it to work.” In fact, Williams was talking, here, in the past tense, about the humble washing machine; once a novel piece of kit that no one could plumb and no one wanted – because housewives were proud, or something. It was presented as a management parable, accredited to one Guenther Dueck, an IBM engineer and writer of “ideological and philosophical non-fiction”.

Williams said: “It is still early. We had the impression back in 2019 that it was going to start [quick], and every enterprise was going to buy a 5G network – because everyone wanted to know about it. But wanting to know about something does not not mean the same as wanting to buy something. Do we think that, in the end, every company will have a 5G network? No. [And] we still have to do work, and believe in it and push it.”

It was a candid review, perhaps a little wearied by the fanfare in the market – and a good response to Tomasi’s opposite-bombast about private 5G “fading away” from operators, and a good advert for telcos at large. She addressed the telco-in-industry jibe directly. “You [doubt] whether telcos are the greatest on earth to provide [private 5G to industry], but we have not reached that proven point yet,” she responded.

“We see research upon research, and the only value for operators is with managing networks. We have no hardware. Building infrastructure… lots of companies do that.” She said no more about the land-grab for control over the supply and management of private 5G networks; just that “time will tell”. More interestingly – and significantly, potentially – she suggested industrial-private 5G will (and must) be twinned with legacy industrial networking, mostly Wi-Fi.

Deutsche Telekom has identified four strategy blocks to scale 5G campus networks business @ Private Networks in a 5G World @5GWorldSeries #3G4G5G #5GWorld #5GWorldSeries #5G #Private5G #5GPrivateNetworks #Private5GNetworks pic.twitter.com/zPiWq1rwQ6

— Free 5G Training (@5Gtraining) June 14, 2022

“We have to have a little patience. [And] we have to [be resourceful] to get this done, and think about combinations. We should not be religious about 5G. If we want 5G to enter the market, it has to adapt to other tech. No one is going to throw-out everything else, and replace it all with 5G. I don’t see that. That is not realistic.” Again, as a single response to the idea the old telco market has a god-complex, it was perfectly judged.

Indirectly, Deutsche Telekom also hit back at this notion that operators are muddying their message to enterprises. The company’s private 5G portfolio (see image, above) looked rounded. Williams explained how its ‘Campus Network S’ product offers “enhanced public comms” with local reinforcements of the macro RAN (the same at Telia’s green layer), its ‘Campus Network M’ and ‘L’ lines introduce a virtual private network (IP VPN) and private core, respectively (Telia’s orange layer), and its fully-private P-series puts everything on site (Telia’s purple layer).

So what’s the deal? It looks like a comprehensive offer. Williams named a couple of different user types: US automotive supplier BorgWarner is taking one or other system from Deutsche Telekom in Hungary; Accenture is going some other way at a plant in Essen; the University Hospital (UKB) in its hometown, Bonn, is doing the same. In general, ‘cost-conscious’ users, lower on the performance and service axes (see image), will go for S-type networks, she said.

If you want to learn more about Campus networks then check out this eBook and Webinar from iBwave. This presentation from Detecon is also a good place to start.

Related Posts:

- 3G4G: Private Networks & 5G Non-Public Networks

- Operator Watch Blog: Deutsche Telekom's 'Tech Grounds' 2021

- The 3G4G Blog: 5G and Industry 4.0

- The 3G4G Blog: What is Industrial IoT (IIoT) and how is it different from IoT?

Comments

Post a Comment